Ready to file your taxes?

Please try to schedule online as our call volumes are extremely high at this time. Thank you for your understanding.

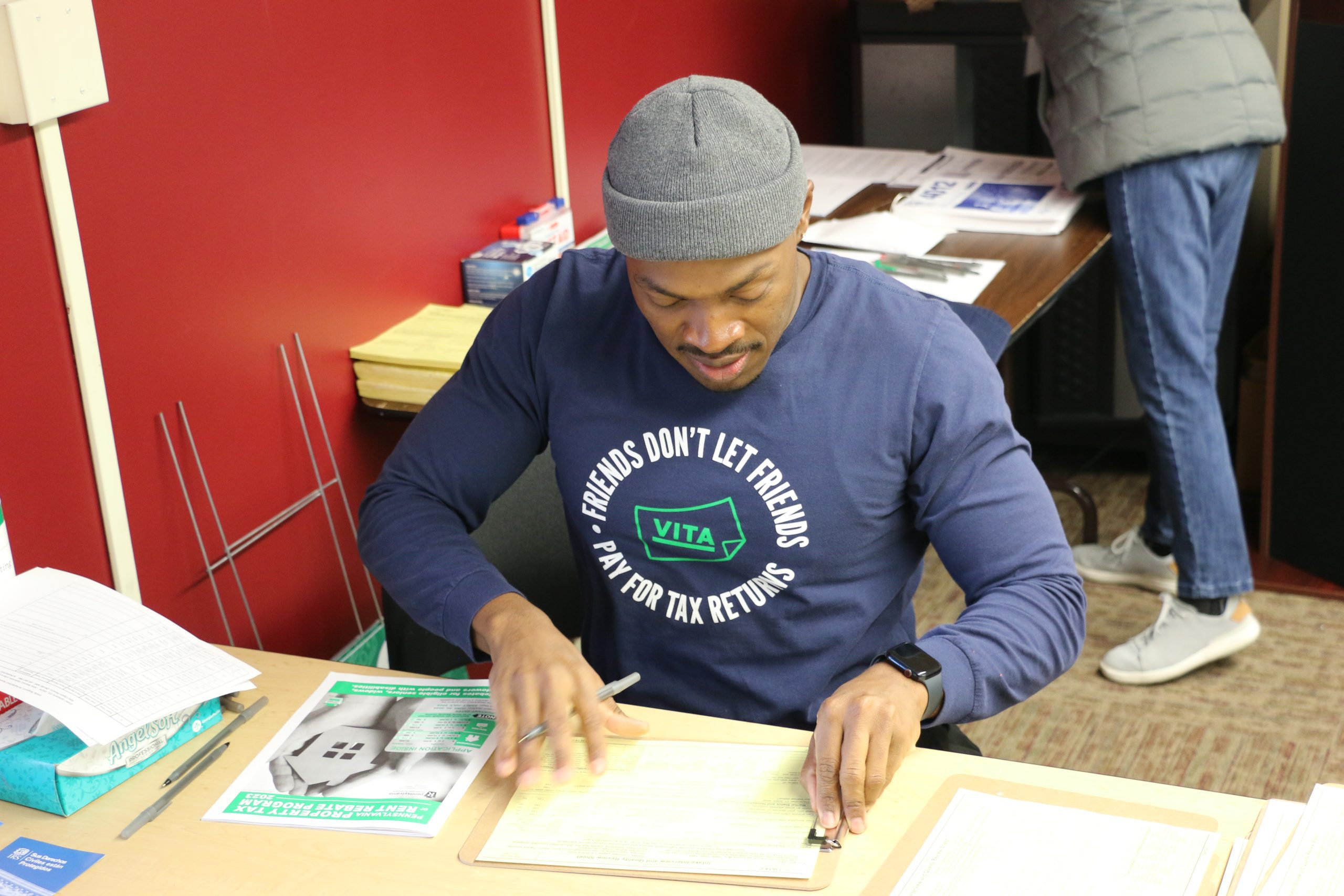

Filing your taxes doesn’t have to be stressful or expensive. United Way of Lancaster County’s VITA program offers free, reliable tax preparation services for individuals and families who qualify. Our IRS-certified volunteers are here to ensure you get the maximum refund and all the credits you’re eligible for, helping you keep more of your hard-earned money.

Whether you prefer to have your taxes prepared in person, virtually, or want to file yourself with some extra guidance, VITA has a solution that fits your needs. We make the process simple and straightforward, with multiple filing options and support every step of the way. Our team is dedicated to providing a safe, confidential, and accurate experience, so you can file with confidence.

Join thousands of Lancaster County residents who trust VITA each year. With our help, you’ll navigate tax season with ease—saving time, avoiding costly fees, and gaining peace of mind.

United Way’s MyFreeTaxes

United Way’s MyFreeTaxes website is another resource you may want to check out.

Please note that MyFreeTaxes.com is not a free resource for taxpayers who have business income (including self-employment income, which includes rideshare drivers), capital gains and losses, or income from rental property. Taxpayers who need to file Schedules C, D, or E will be charged on the MyFreeTaxes.com website.

Get StartedOther Tax Filing Options

The IRS has a helpful search for filing options so you can identify the best provider for you. It is also important to remember to file your local taxes, which must be done separately.

Be Aware of Scams

Thousands of people have lost millions of dollars and their personal information to tax scams. Scammers use the regular mail, telephone, or email to set up individuals, businesses, payroll and tax professionals. The IRS doesn’t initiate contact with taxpayers by email, text messages or social media channels to request personal or financial information. Recognize the telltale signs of a scam »

Español