Educational Improvement Tax Credit

’25 – ’26 School Year

EXTENDED: Applications will close on Friday February 13th at midnight

| Diamond Street Early Childhood Center | Elizabethtown Child Care Center | Elizabethtown Community Nursery School | Lititz Christian Early Learning Center | Little People Daycare School of Columbia |

| Luthercare | Tomorrow’s World Early Learning Center, Inc. | U-GRO Learning Centres Elizabethtown | UniVision | YMCA of the Roses |

| U-GRO |

The Educational Improvement Tax Credit Scholarship Program is funded by local and locally represented businesses which uphold the value of early childhood education, and the immense impact quality pre-k has on children’s developmental needs as they begin their K-12 education track. United Way of Lancaster County works directly with the PA Department of Economic Development (PA DCED) in obtaining EITC credits and transforming them into scholarship funds for local families with Pre-K scholars. If you have any questions about the process, we ask that you direct them to your school’s director who will reach out to their contact at United Way.

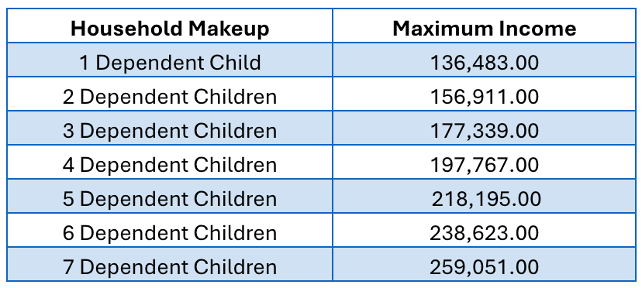

To qualify for a scholarship, students must be between the ages of 3-5 and enrolled in a high-quality, district-aligned Pre-K program that is partnered with United Way of Lancaster County. Households must fall be within the maximum income chart below:

Watch this 2-minute video to learn how your business can earn a tax credit by investing in early learning.

Children are our future!

At United Way of Lancaster County, we are dedicated to giving children the best chance for success in school and in life through programs like the Educational Improvement Tax Credit (EITC).

As part of this commitment, we offer scholarship assistance to children in financial need for Pre-Kindergarten programs. These scholarships, averaging $1,500 per child, enable eligible children ages 3-6 in Lancaster County to attend high-quality Pre-K programs.

United Way of Lancaster County is proud to be an approved Pre-Kindergarten Scholarship Organization under the Educational Improvement Tax Credit (EITC) program, authorized by the Pennsylvania Department of Community and Economic Development (DCED).

What is the Educational Improvement Tax Credit?

The EITC program provides tax credits to eligible businesses that contribute to qualified organizations. These tax credits may be applied against a business’s tax liability for the year in which the donation was made.

Businesses can receive a 100% tax credit for the first $10,000 contributed to a Pre-Kindergarten Scholarship Organization (like United Way of Lancaster County) during the tax year. For any additional contributions beyond $10,000, businesses can receive a 90% tax credit, up to a maximum of $200,000 in tax credits per year.

Who is eligible?

Businesses authorized to do business in Pennsylvania who are subject to one or more of the following taxes:

- Personal Income Tax

- Capital Stock/Foreign Franchise Tax

- Corporate Net Income Tax

- Bank Shares Tax

- Title Insurance & Trust Company Shares Tax

- Insurance Premium Tax (excluding surplus lines, unauthorized, domestic/foreign marine)

- Mutual Thrift Tax

- Malt Beverage Tax

- Retaliatory Fees under section 212 of the Insurance Company Law of 1921

Why choose United Way?

While other organizations may be tied to specific pre-K programs, contributions to United Way of Lancaster County benefit the entire community. We invest scholarship funds across a variety of high-quality pre-K programs throughout Lancaster County, ensuring that resources are distributed where they’re needed most to strengthen the whole county.

It’s a triple win!

- Local companies win by reducing their taxes while investing in Lancaster’s community and future workforce.

- Parents win because they can be more productive at work, knowing their children are receiving high-quality early care and education.

- Children win by being enrolled in nurturing programs that prepare them to enter school ready to learn.

Timeline for Submissions:

May 17:

- Businesses that have completed their 2-year commitment and wish to renew their commitment for the next fiscal year

- Businesses halfway through their 2-year commitment

July 1:

- All other businesses

- First-time business applicants

- Businesses wishing to submit an additional application beyond their existing 2-year commitment

How to Apply:

Pennsylvania businesses can apply for EITC credits through DCED’s electronic single application system.

The business guidelines (PowerPoint Registration Tutorial) explain the application process. Applications are processed on a first-come, first-served basis, subject to the availability of tax credits.

This credit is a simple and impactful way for your business to save money while supporting the children of Lancaster County!